Understanding the changes to R&D Tax Credits

posted 12th December 2022

R&D Tax Credits are designed to support investment, and therefore increase productivity and growth amongst UK businesses by rewarding innovation.

Since then, the Government delivered an Autumn Statement that confirmed changes to the R&D tax system. Here, GS Verde’s tax experts explore the details of these updates and how they could affect businesses.

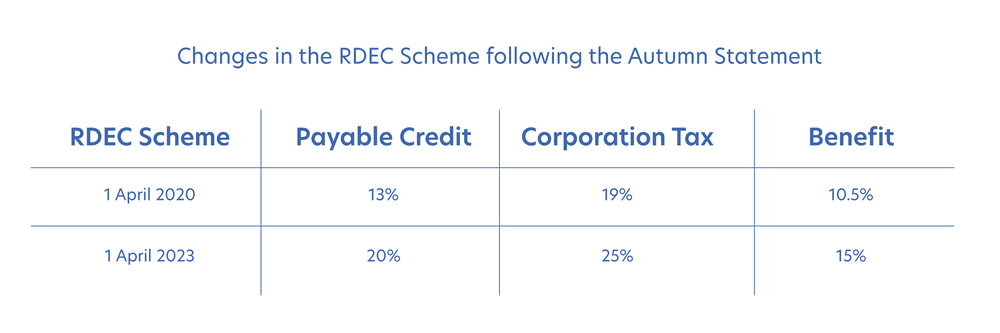

R&D Expenditure Credit:

R&D Expenditure Credit is one of the two tax credit incentives available in the UK. This tax relief is primarily aimed at large companies.

Chancellor Jeremey Hunt announced last month in the Autumn Statement that the rate will increase from 13% to 20%, and this measure will take effect for expenditure incurred on or after 1st April 2023.

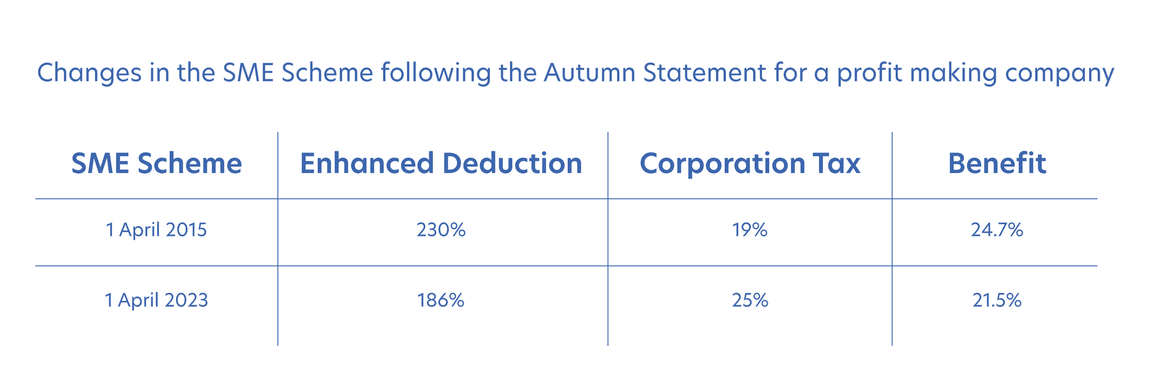

R&D Tax Credits:

Aimed at SMEs rather than large companies, the second tax credit incentive was cut by the Chancellor. The enhanced deduction rate is due to be reduced from 130% to 86% and the repayable tax credit decreased from 14.5% to 10%.

As above, this change will be effective from 1st April next year.

These rate changes will be legislated in the Autumn Finance Bill 2022.

The rationale behind these reforms was, as set out by the Government, the need to improve the competitiveness of the RDEC scheme to increase overall R&D investment, and move towards a simplified, single RDEC-like scheme for all. Ahead of the next budget, the Government says it will work with industries to understand what further support is needed for R&D intensive SMEs.

Do the R&D Tax credits changes affect your business' claim?

It is paramount that entrepreneurs and businesses review their current tax standings and future plans, in light of these reforms. For many SMEs, R&D tax credits form a substantial part of financial and investment plans that forecast several years ahead.

These changes come with just four months’ notice: not considering the impact of the new policy could therefore have significant repercussions.

As part of the wider GS Verde Group, GS Verde Tax provides expert advice to companies and business owners, helping them to make practical and informed decisions. Our tailored support and guidance ensure compliance while performing appropriate R&D tax credit calculations to help maximise the reliefs available.

Submit your details below to talk to our tax specialist team about your R&D Tax Credit application.